Family Land

It is not unusual for today’s farming families to have worked for generations building their land holdings. Oftentimes, first generational land ownership can be traced as far back as the 1862 Homestead Act. Preserving this legacy asset can be of central importance to those who have toiled to build it.

Land ownership is a real asset and when managed properly it can provide value and cash flow for current and future generations. At Capitaline we understand land and we understand the importance of passing along a family legacy.

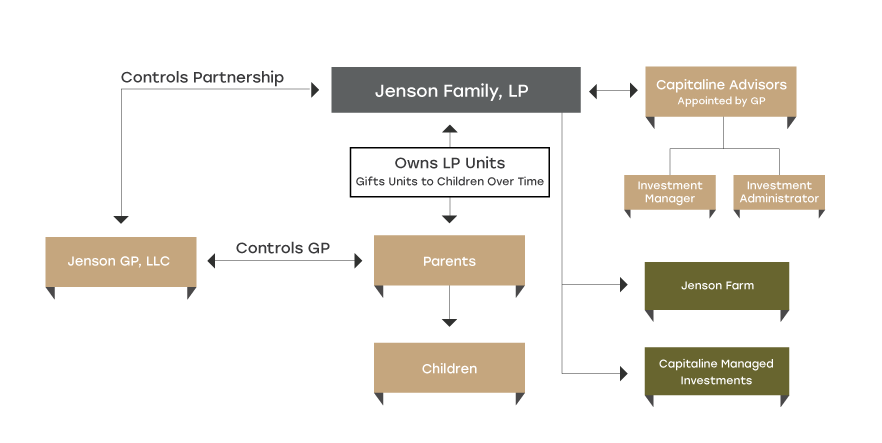

Capitaline utilizes Family Limited Partnerships as a structure to hold and manage family farmland. We also provide Farmland Management services for land held within the family partnership. The reality is as generational layers are added and family members disperse, complexities increase. Capitaline can help identify and manage these complexities.